Keliber/Sibanye-Stillwater

Keliber/Sibanye-Stillwater

The EU wants to revive mining in Europe. One stumbling block: it does not have the money to give its ambitions the foundations they need. Banks shy away from what they see as risky trades, while the sector is controlled by non-European actors.

Gathered in the Berlaymont hotel in late January, a short walk from the EU offices and Belgium’s national car and military history museums, executives from Europe’s leading banks were called to action. “I want you to invest,” European Commissioner Thierry Breton told the financiers, “in operations in the critical raw materials value chain.”

Two months later, the European Commission presented its draft Critical Raw Materials Act. The CRMA, which could be among the fastest EU laws ever adopted by early 2024, wants to guarantee Europe’s supply of nickel, lithium, magnesium and other materials essential for the green transition and strategic industries. They are vital for electric cars and renewable energy, military equipment and aerospace systems, as well as laptops and mobile phones.

The Commission wants new mines to open across Europe, reducing the bloc’s dependency on China, but there is a problem. One which Thierry Breton’s hotel gathering reflected: the Commission has no specific fund to finance its CRMA ambitions.

Instead, they want to make it easier for companies to raise money by designating certain mining projects as strategic. The Commission is aware that “private investment alone is not sufficient” and projects may also require public funds. Germany plans to commit between €500 million and €1 billion to support the mining of critical raw materials. In May, the French government announced it would contribute €500 million to a dedicated investment pot, to be run by a private equity fund.

But not all countries are so well-off.

“We are obviously concerned about the different budgetary capacities of different countries,” says Portugal’s energy minister Ana Fontoura. “We advocate a strong framework for state aid, because the European Union must incentivise European industry, but at the same time not create internal imbalances.”

Which projects are deemed “strategic” and thus can access priority EU funds is still being debated, with the industry lobbying hard for a broad definition. “It is not necessarily the task of the EU to finance mining,” German Green MEP Henrike Hahn says. “Companies ask banks for credit, but banks aren’t strongly interested in investing in that sector. So, some companies need the certifications as strategic projects.”

Two months later, the European Commission presented its draft Critical Raw Materials Act. The CRMA, which could be among the fastest EU laws ever adopted by early 2024, wants to guarantee Europe’s supply of nickel, lithium, magnesium and other materials essential for the green transition and strategic industries. They are vital for electric cars and renewable energy, military equipment and aerospace systems, as well as laptops and mobile phones.

The Commission wants new mines to open across Europe, reducing the bloc’s dependency on China, but there is a problem. One which Thierry Breton’s hotel gathering reflected: the Commission has no specific fund to finance its CRMA ambitions.

Instead, they want to make it easier for companies to raise money by designating certain mining projects as strategic. The Commission is aware that “private investment alone is not sufficient” and projects may also require public funds. Germany plans to commit between €500 million and €1 billion to support the mining of critical raw materials. In May, the French government announced it would contribute €500 million to a dedicated investment pot, to be run by a private equity fund.

But not all countries are so well-off.

“We are obviously concerned about the different budgetary capacities of different countries,” says Portugal’s energy minister Ana Fontoura. “We advocate a strong framework for state aid, because the European Union must incentivise European industry, but at the same time not create internal imbalances.”

Which projects are deemed “strategic” and thus can access priority EU funds is still being debated, with the industry lobbying hard for a broad definition. “It is not necessarily the task of the EU to finance mining,” German Green MEP Henrike Hahn says. “Companies ask banks for credit, but banks aren’t strongly interested in investing in that sector. So, some companies need the certifications as strategic projects.”

European Commissioner Thierry Breton has urged Europe's banks to invest in the critical raw materials sector. (Credit: Shutterstock)Shutterstock

Germany plans to commit up to €1 billion to support the mining of critical raw materials. (Credit: Kya/Flickr CC by NC-ND 4.0)Kya/Flickr CC by NC-ND 4.0

The concerns come from complex context. The war in Ukraine has demanded an enormous financial effort from the EU. Meanwhile, on the other side of the Atlantic, the United States has approved a massive aid plan, the Inflation Reduction Act (IRA), which foresees an investment of $369 billion, part of which will go to climate and energy investments.

“The IRA is stealing all of the investments,” says Rolf Kuby, director-general at industry body Euromines. “Our pledge to have a raw materials fund at European level was never positively received. We are in the phase where everybody is shouting for money.”

Commission President Ursula Von Der Leyen tried to counter the US IRA with a massive European subsidies plan. The idea of the European Sovereignty Fund was to resort to the financial markets with soft loans but many northern countries rejected the idea of a common green transition financing plan.

How much public money is needed? Euromines does not know. “It is impossible to give a figure,” says Kuby, adding that funding “needs to be high enough to be comparable, at least with IRA, and to answer to the Chinese investment and subsidies, because this is an elephant in the room”.

What Kuby does know is where the public money should go: to exploration. “If we want new mines to open tomorrow, we need to have a clear focus on exploration. And that is a highly risky business. That is a business that is not necessarily done by the majors, there are more small geological exploration companies. And it is an asset if Europe finds a way to help those exploring companies.”

“The IRA is stealing all of the investments,” says Rolf Kuby, director-general at industry body Euromines. “Our pledge to have a raw materials fund at European level was never positively received. We are in the phase where everybody is shouting for money.”

Commission President Ursula Von Der Leyen tried to counter the US IRA with a massive European subsidies plan. The idea of the European Sovereignty Fund was to resort to the financial markets with soft loans but many northern countries rejected the idea of a common green transition financing plan.

How much public money is needed? Euromines does not know. “It is impossible to give a figure,” says Kuby, adding that funding “needs to be high enough to be comparable, at least with IRA, and to answer to the Chinese investment and subsidies, because this is an elephant in the room”.

What Kuby does know is where the public money should go: to exploration. “If we want new mines to open tomorrow, we need to have a clear focus on exploration. And that is a highly risky business. That is a business that is not necessarily done by the majors, there are more small geological exploration companies. And it is an asset if Europe finds a way to help those exploring companies.”

“If we want new mines to open tomorrow, we need to have a clear focus on exploration.”

— Rolf Kuby, Euromines

Within the mining industry, a distinction can be made between the majors, mid-tiers and juniors. The majors are transnational companies that profit from the exploitation of the mines, while juniors are smaller and often focus on high-risk exploration projects.

Despite consuming between 25 and 30 per cent of the world’s metals, spending on mineral exploration in Europe is around 3 per cent, according to the EU. This could change if the CRMA translates from written rhetoric into action on the ground. For officials, the law is not only about reducing Europe’s dependency on China and elsewhere, but is an attempt to go green, free from fossil fuels.

The European Commission reckons that, compared to 2020, Europe will need access to 18 times more lithium by 2030 and 60 times more by 2050, to meet projected demand for energy storage and electric vehicles, which predominantly use lithium-powered batteries.

In July 2019, an industry publication analysed the seven major lithium mining projects that existed in Europe at the time. Only one of them was being managed by a major, the Anglo-Australian company Rio Tinto, in Serbia. The other six belonged to small companies. In January 2022, the Serbian government revoked Rio Tinto’s licences to mine lithium after months of widespread protests.

Despite consuming between 25 and 30 per cent of the world’s metals, spending on mineral exploration in Europe is around 3 per cent, according to the EU. This could change if the CRMA translates from written rhetoric into action on the ground. For officials, the law is not only about reducing Europe’s dependency on China and elsewhere, but is an attempt to go green, free from fossil fuels.

The European Commission reckons that, compared to 2020, Europe will need access to 18 times more lithium by 2030 and 60 times more by 2050, to meet projected demand for energy storage and electric vehicles, which predominantly use lithium-powered batteries.

In July 2019, an industry publication analysed the seven major lithium mining projects that existed in Europe at the time. Only one of them was being managed by a major, the Anglo-Australian company Rio Tinto, in Serbia. The other six belonged to small companies. In January 2022, the Serbian government revoked Rio Tinto’s licences to mine lithium after months of widespread protests.

Crowds in Belgrade, Serbia block the Gazela bridge in protest against Rio Tinto's lithium mine plans. December, 2021. Shutterstock

And while the other six projects are still active, none of the mines have opened. However, every so often, the promoters announce a new development. These are Barroso, in Portugal, managed by Savannah Resources; Wolfsberg, in Austria, owned by European Lithium; Cinovec, in the Czech Republic, in the hands of European Metals; San José, in Spain, that belongs to Infinity Lithium; Zinnwald, in Germany, then controlled by Bacanora Lithium; and Keliber, in Finland, managed by Keliber Oy. The latter is the most advanced and has already been bought by one of the majors, the South African multinational Sibanye-Stillwater.

Elsewhere, Vulcan Energy Resources launched a pilot project in 2021 in Germany’s Rhine Valley to produce “zero-carbon” green lithium. This year, the chemical giant Nobian acquired a 50 per cent stake in the project. France’s Imerys, meanwhile, plans to start mining a lithium deposit in the Massif Central in 2028.

Elsewhere, Vulcan Energy Resources launched a pilot project in 2021 in Germany’s Rhine Valley to produce “zero-carbon” green lithium. This year, the chemical giant Nobian acquired a 50 per cent stake in the project. France’s Imerys, meanwhile, plans to start mining a lithium deposit in the Massif Central in 2028.

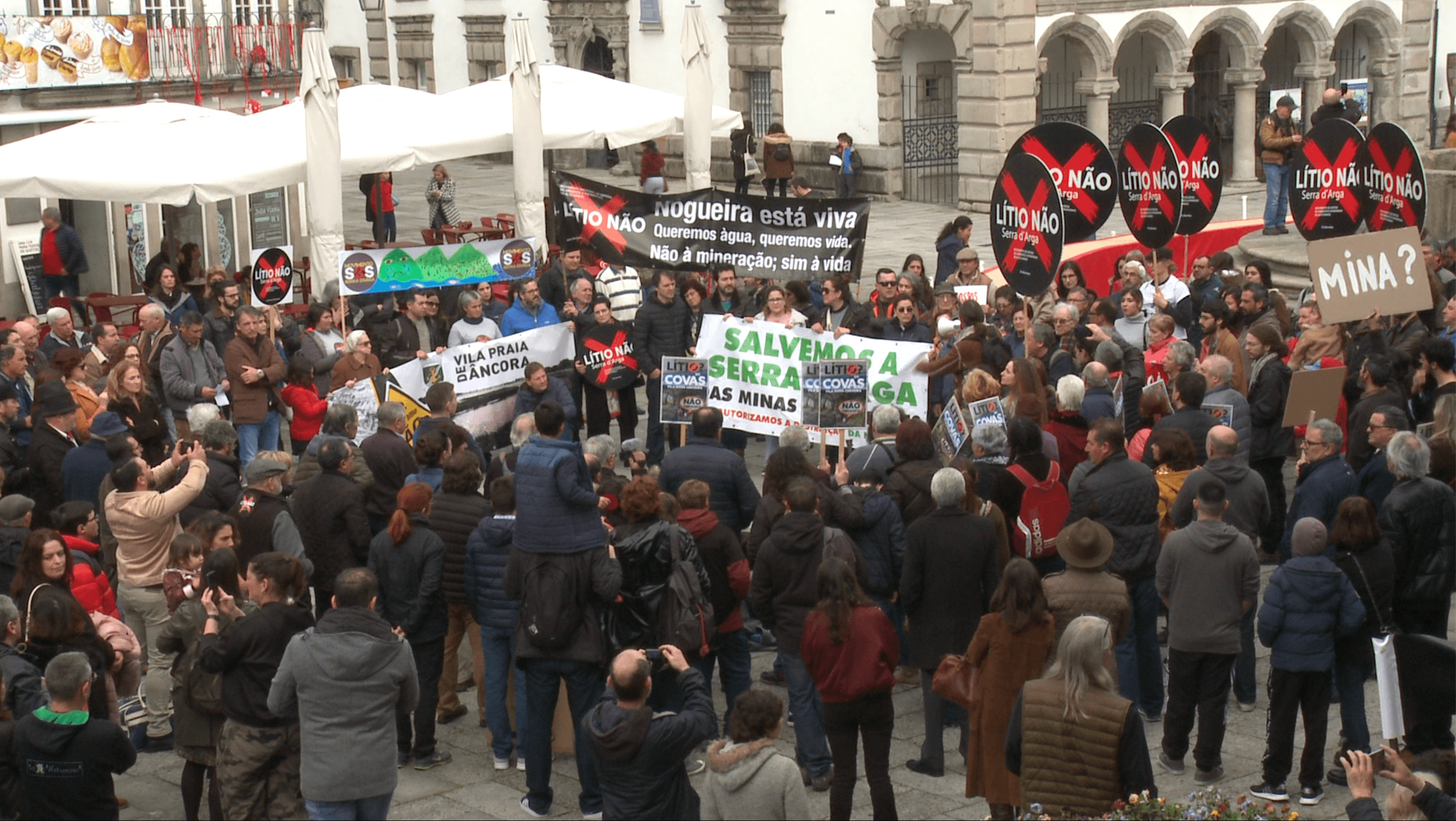

In northern Portugal, a major lithium mine development is underway in Barroso. (Credit: Vítor Martinho/Tiago Carrasco)

Locals campaign against the project, which could impact protected nature areas. (Credit: Vítor Martinho/Tiago Carrasco)Tiago Carrasco

Companies exploring for new deposits are generally not financed on stock exchanges in the EU, but in Canada and Australia. The growing interest in raw materials linked to the ecological transition is having an impact on these markets. Last month, the Toronto Stock Exchange released its annual ranking of the 30 best-performing stocks over the last three years. Seven were mining companies (all non-European) with an average price increase of 615 per cent.

Investigate Europe analysed the world’s 200 largest mining companies by market capitalisation, using data from the end of last July. Notably, only 15 are European, and only six are based in the EU. Companies from Canada (38 per cent), the US (37 per cent) and Australia (33 per cent) dominate the market.

As in so many other businesses, the major shareholders are often investment funds. Blackrock controlled more than 4 per cent of the equity in 10 of the 200 companies. Others include The Vanguard Group, Van Eck Associates and First Eagle Invesment Management. All four are headquartered in the US.

There are some mining billionaires from the EU. For example, Spain’s Daniel Maté and Greece’s Telis Mistakidis, who each control around 3 per cent of Glencore, the Swiss commodity giant with the fourth largest market capitalisation. Others have enormous fortunes, even if their companies are not among the top 200, such as the French Duval family, which control Eramet, a major nickel producer.

Investigate Europe analysed the world’s 200 largest mining companies by market capitalisation, using data from the end of last July. Notably, only 15 are European, and only six are based in the EU. Companies from Canada (38 per cent), the US (37 per cent) and Australia (33 per cent) dominate the market.

As in so many other businesses, the major shareholders are often investment funds. Blackrock controlled more than 4 per cent of the equity in 10 of the 200 companies. Others include The Vanguard Group, Van Eck Associates and First Eagle Invesment Management. All four are headquartered in the US.

There are some mining billionaires from the EU. For example, Spain’s Daniel Maté and Greece’s Telis Mistakidis, who each control around 3 per cent of Glencore, the Swiss commodity giant with the fourth largest market capitalisation. Others have enormous fortunes, even if their companies are not among the top 200, such as the French Duval family, which control Eramet, a major nickel producer.

As of now, most mining fortunes are not made in Europe. The majors operate 17 CRM mines in the EU, mostly copper. They have seven other projects in the pipeline to extract lithium, cobalt, copper or nickel. Those companies also have five metal recycling or processing plants, four of them already operative. The International Energy Agency estimates there are between 40 and 50 critical raw materials mines in the EU today. Euromines’ Kuby wants to see this number doubled in the next decade.

Can this situation change in the future, as the EU hopes will happen with its new mining legislation? Perhaps the answer lies with EU Commissioner Margrethe Vestager. “The way you do mining is absolutely essential. Many credit institutions will not touch you unless they think you are in control of how you deal with the people who live where the mines are, how you deal with the environmental offence, and how you can restore the area once you are done,” Vestager told Investigate Europe.

Additional reporting by Maria Maggiore, Nico Schmidt, Atilla Kálmán, Eurydice Bersi and Paulo Pena.

Editor: Chris Matthews

Graphics: Marta Portocarrero

This investigation is supported by Journalismfund Europe’s Investigation Grants for Environmental Journalism.

Can this situation change in the future, as the EU hopes will happen with its new mining legislation? Perhaps the answer lies with EU Commissioner Margrethe Vestager. “The way you do mining is absolutely essential. Many credit institutions will not touch you unless they think you are in control of how you deal with the people who live where the mines are, how you deal with the environmental offence, and how you can restore the area once you are done,” Vestager told Investigate Europe.

Additional reporting by Maria Maggiore, Nico Schmidt, Atilla Kálmán, Eurydice Bersi and Paulo Pena.

Editor: Chris Matthews

Graphics: Marta Portocarrero

This investigation is supported by Journalismfund Europe’s Investigation Grants for Environmental Journalism.