Greenpeace/Daniel Beltrá

27 October 2023 Manuel Rico

Manuel Rico Lorenzo Buzzoni

Lorenzo Buzzoni

Firms linked to environmental abuses got millions in EU ‘green mining’ grants

Greenpeace/Daniel Beltrá

Firms linked to environmental abuses got millions in EU ‘green mining’ grants

27 October 2023The Horizon scheme has funded 95 projects related to critical raw materials since 2014. Investigate Europe finds that millions went to companies accused of ecological wrongdoing. As well as others linked to oligarchs, a firm owned by the Chinese state, and another in a Caribbean tax haven.

One year in prison and €293,000 in compensation. That was the ruling of a Seville court in September 2016 against three executives of the mining company Cobre Las Cruces SA. The trio confessed to one count of environmental crime - contamination of an aquifer near the copper mine with arsenic, and one count of damage to the public domain - the company had illegally extracted more water than permitted.

Six months earlier, and despite the ongoing legal proceedings which started in 2008, Cobre Las Cruces began coordinating a project called Intmet, which aimed "to maximise metal recovery yield and minimising energy consumption and environmental footprint."

Intmet was part of the Horizon programme. It was funded by the European Commission to the tune of €7.8 million, of which €2.73 million went to Cobre Las Cruces. The firm, based in Spain but owned by Canada’s First Quantum Minerals, has been chosen to participate in seven Horizon projects related to critical raw materials (CRMs). Minerals and metals essential for Europe's green transition and everyday electronics. In total, it will pocket €5.53 million in public money - the second highest total of European firms awarded funding.

Less than 20 kilometres from the Cobre Las Cruces mine is the town of Aznalcóllar, where one of the biggest environmental disasters in European mining in the last 50 years occurred in 1998. The rupture of the Aznalcóllar pyrite mine pond discharged six million cubic metres of toxic sludge into a nearby river, killed thousands of fish and damaged 4,634 hectares. Some land was so contaminated it could no longer be farmed.

The mine was owned by Boliden, a Swedish multinational, which paid around €40 million for the damage caused by the disaster. However, its Spanish subsidiary declared bankruptcy soon after, with the Spanish government still owed the €43 million it spent on the clean-up, and local authorities short of the €89 million they spent on restoration. Boliden is not paying but is collecting money from European taxpayers. The firm has received €2.7 million for its role in eight Horizon projects. Several of which aim “to minimize environmental impact of mining operations".

Six months earlier, and despite the ongoing legal proceedings which started in 2008, Cobre Las Cruces began coordinating a project called Intmet, which aimed "to maximise metal recovery yield and minimising energy consumption and environmental footprint."

Intmet was part of the Horizon programme. It was funded by the European Commission to the tune of €7.8 million, of which €2.73 million went to Cobre Las Cruces. The firm, based in Spain but owned by Canada’s First Quantum Minerals, has been chosen to participate in seven Horizon projects related to critical raw materials (CRMs). Minerals and metals essential for Europe's green transition and everyday electronics. In total, it will pocket €5.53 million in public money - the second highest total of European firms awarded funding.

Less than 20 kilometres from the Cobre Las Cruces mine is the town of Aznalcóllar, where one of the biggest environmental disasters in European mining in the last 50 years occurred in 1998. The rupture of the Aznalcóllar pyrite mine pond discharged six million cubic metres of toxic sludge into a nearby river, killed thousands of fish and damaged 4,634 hectares. Some land was so contaminated it could no longer be farmed.

The mine was owned by Boliden, a Swedish multinational, which paid around €40 million for the damage caused by the disaster. However, its Spanish subsidiary declared bankruptcy soon after, with the Spanish government still owed the €43 million it spent on the clean-up, and local authorities short of the €89 million they spent on restoration. Boliden is not paying but is collecting money from European taxpayers. The firm has received €2.7 million for its role in eight Horizon projects. Several of which aim “to minimize environmental impact of mining operations".

The Aznalcóllar mining disaster in 1998 caused the discharge of six million cubic metres of toxic sludge. (Greenpeace / Daniel Beltrá)Greenpeace/Daniel Beltrá

The toxic spill occurred near the Coto Donana national park and impacted almost 5,000 hectares in southern Spain. (Greenpeace / Daniel Beltrá)Greenpeace/Daniel Beltrá

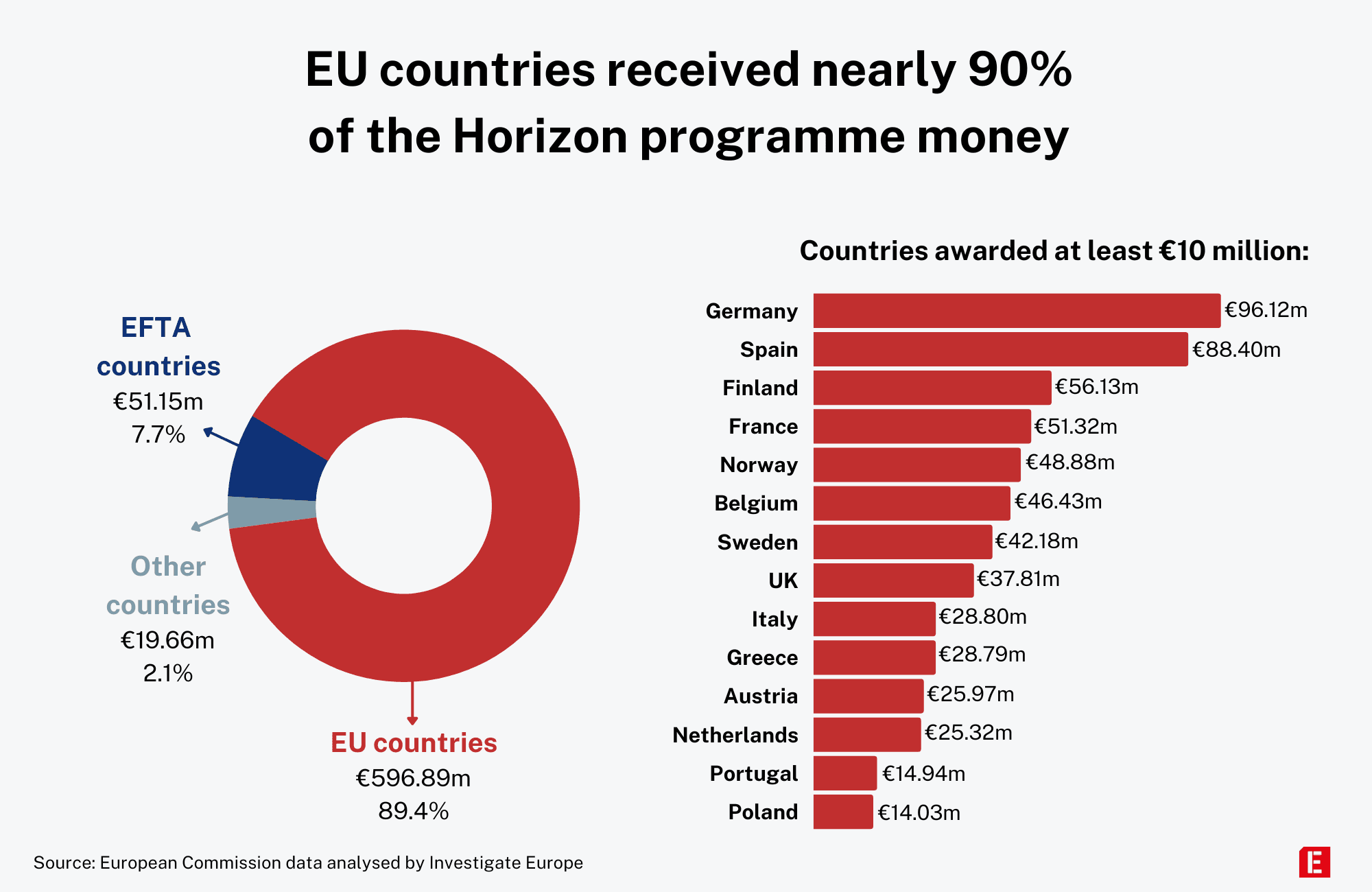

Investigate Europe has analysed all CRM-related projects funded by Horizon 2020, the EU’s flagship scientific research scheme with a budget of €80 billion between 2014 and 2020. And its successor, Horizon Europe, which plans to distribute €95.5 billion between 2021 and 2027. Horizon funding covers issues ranging from the climate crisis to medicines and food security.

The UK announced in September it would rejoin the scheme after a Brexit-enforced absence. Among the thousands of projects supported, 95 are directly related to CRMs. These received €667 million and involve 1,043 entities, including companies, universities and research centres.

Such attacks on the environment by companies receiving EU funds have not only occurred in Europe. Boliden was named in a report on human rights violations by companies in third countries, requested by the European Parliament. The Swedish giant was accused of exporting mining waste to Chile, where a subcontractor disposed of it without treating it properly, harming the health of local communities.

The UK announced in September it would rejoin the scheme after a Brexit-enforced absence. Among the thousands of projects supported, 95 are directly related to CRMs. These received €667 million and involve 1,043 entities, including companies, universities and research centres.

Such attacks on the environment by companies receiving EU funds have not only occurred in Europe. Boliden was named in a report on human rights violations by companies in third countries, requested by the European Parliament. The Swedish giant was accused of exporting mining waste to Chile, where a subcontractor disposed of it without treating it properly, harming the health of local communities.

France’s Eramet, which received €1.9 million for four Horizon projects, faces allegations of destroying forests and lands of indigenous communities in Indonesia affected by the development of Weda Bay, the world’s largest nickel mine. Société Le Nickel, an Eramet subsidiary and Horizon fundee, is under scrutiny for alleged environmental damage in New Caledonia.

The UK’s Anglo American, which received just over €200,000 from a Horizon project, is facing a class action lawsuit over the alleged mass lead poisoning of children in Zambia. It has also faced pollution allegations in Brazil and elsewhere. Investigate Europe identified more than a dozen companies who received Horizon funds related to the green transition and at the same time alleged perpetrators of environmental wrongdoing.

The UK’s Anglo American, which received just over €200,000 from a Horizon project, is facing a class action lawsuit over the alleged mass lead poisoning of children in Zambia. It has also faced pollution allegations in Brazil and elsewhere. Investigate Europe identified more than a dozen companies who received Horizon funds related to the green transition and at the same time alleged perpetrators of environmental wrongdoing.

“ The Commission gives thorough consideration to environmental factors in relation to projects.”

— EU Commission

When asked whether committing environmental crimes was compatible with receiving subsidies, the EU Commission said it "gives thorough consideration to environmental factors in relation to projects funded", pointing out that the European Green Deal introduced the principle of "do not significant harm". The spokesperson added that in Horizon Europe, participants must demonstrate projects respect the EU's climate and environmental priorities. They did not comment on the Cobres Las Cruces or Boliden cases nor on why others accused of wrongdoing had been so well supported.

The data holds more surprises. The EU is eager to reduce its current dependency on others for critical raw materials, especially China, but also Russia which remains a significant supplier. None of the 11 sanctions packages have targeted the trade. Investigate Europe revealed this week that Europe has continued to buy nickel, copper and titanium from Russia in vast quantities.

Indeed, Horizon’s public money has also ended up in Chinese or Russian hands.

The data holds more surprises. The EU is eager to reduce its current dependency on others for critical raw materials, especially China, but also Russia which remains a significant supplier. None of the 11 sanctions packages have targeted the trade. Investigate Europe revealed this week that Europe has continued to buy nickel, copper and titanium from Russia in vast quantities.

Indeed, Horizon’s public money has also ended up in Chinese or Russian hands.

A nickel mine in Indonesia. French firm Eramet has faced allegations of wrongdoing at its projects in the country.Shutterstock

Soil Machine Dynamics, a leading underwater robotics company, received €3.53 million from Horizon’s budget for the Vamos project, which aimed to develop a new technique to extract minerals from previously unreachable depths. The project started on 1 February 2015, and five days later, the private equity fund Inflexion announced it had sold the UK company to Zhuzhou CSR Times Electric. An entity whose majority shareholder is the Chinese state. Vamos ran until 31 January 2019.

Ireland-based Aughinish Alumina refines bauxite, the rock from which alumina used to produce aluminium is extracted. It has been owned since 2007 by Rusal, a Russian group that dominates the sector and one of whose key shareholders is Oleg Deripaska, who is on the EU, UK and US sanctions list. Aughinish Alumina is also included in another list, that of Horizon beneficiaries. It received €563,500 for its participation in a project investigating how “to render bauxite residue reuse viable from an economical point of view and acceptable for the industry”.

A significant shareholder in Rusal is another well-known oligarch, Viktor Vekselberg, a billionaire who groups part of his investments in a holding company called Renova. Until 2018, Renova held a majority stake in the South African company Transalloys, which produces manganese ferroalloys, although that year it reduced its shareholding to below 25 per cent. Renova and Transalloys both refused to comment on the current shareholding structure.

Ireland-based Aughinish Alumina refines bauxite, the rock from which alumina used to produce aluminium is extracted. It has been owned since 2007 by Rusal, a Russian group that dominates the sector and one of whose key shareholders is Oleg Deripaska, who is on the EU, UK and US sanctions list. Aughinish Alumina is also included in another list, that of Horizon beneficiaries. It received €563,500 for its participation in a project investigating how “to render bauxite residue reuse viable from an economical point of view and acceptable for the industry”.

A significant shareholder in Rusal is another well-known oligarch, Viktor Vekselberg, a billionaire who groups part of his investments in a holding company called Renova. Until 2018, Renova held a majority stake in the South African company Transalloys, which produces manganese ferroalloys, although that year it reduced its shareholding to below 25 per cent. Renova and Transalloys both refused to comment on the current shareholding structure.

Investigate Europe

Most Horizon recipients are from the EU, but there are exceptions, including Transalloys. Since January 2023 it been part of the HalMan project, which aims to develop a process to extract manganese in a more sustainable way using hydrogen. The South African company will receive just over €73,000 from the EU budget.

European taxpayers’ money has also gone to a company based in the British Virgin Islands, one of the world’s most infamous tax havens. Lancaster Exploration Limited participated in a project aimed at providing Europe’s high-tech industry with new "exploration models for alkaline and carbonatite provinces". Lancaster specialises in rare earth exploration in Africa and received more than €168,000 of Horizon money.

“As a general rule, legal entities must comply with any applicable legislation, including tax legislation," a European Commission spokesperson said when asked about such funding. He said the EU has powers to terminate funding if a participant breaches “tax obligations” or was “created under a different jurisdiction with the intent to circumvent fiscal, social or other legal obligations in the country of origin."

European taxpayers’ money has also gone to a company based in the British Virgin Islands, one of the world’s most infamous tax havens. Lancaster Exploration Limited participated in a project aimed at providing Europe’s high-tech industry with new "exploration models for alkaline and carbonatite provinces". Lancaster specialises in rare earth exploration in Africa and received more than €168,000 of Horizon money.

“As a general rule, legal entities must comply with any applicable legislation, including tax legislation," a European Commission spokesperson said when asked about such funding. He said the EU has powers to terminate funding if a participant breaches “tax obligations” or was “created under a different jurisdiction with the intent to circumvent fiscal, social or other legal obligations in the country of origin."

“The picture people have of mining has been shaped by past behaviours that were not good examples.”

— Vitor Correia, International Raw Materials Observatory

Despite the apparent willingness of the EU to fund all manner of companies, the presence of big industry is essential, says Josep Oliva, a professor at the Polytechnic University of Catalonia. He coordinated a 2014 Horizon project on using artificial intelligence to improve processes with tungsten and tantalum.

"We needed raw materials to work with,” Oliva says. “And this was provided by the companies. We worked with mines in Austria, the UK and Spain. And then it is important to work with the companies to transfer the results.”

According to the Commission’s own classification 45 per cent of the Horizon money went to for-profit companies, 28 per cent to universities or educational institutions and 20 per cent to research centres.

The research covers broad fields and objectives. This includes a project on the competitiveness of European mineral resources, another on developing a "bio-inspired, modular and reconfigurable robot” for mining difficult deposits and others on artificial intelligence and battery recycling. Two projects, Ciran and Next, were specifically focused on improving “social acceptance” of mining within Europe.

"We needed raw materials to work with,” Oliva says. “And this was provided by the companies. We worked with mines in Austria, the UK and Spain. And then it is important to work with the companies to transfer the results.”

According to the Commission’s own classification 45 per cent of the Horizon money went to for-profit companies, 28 per cent to universities or educational institutions and 20 per cent to research centres.

The research covers broad fields and objectives. This includes a project on the competitiveness of European mineral resources, another on developing a "bio-inspired, modular and reconfigurable robot” for mining difficult deposits and others on artificial intelligence and battery recycling. Two projects, Ciran and Next, were specifically focused on improving “social acceptance” of mining within Europe.

“Most mining companies active in Europe now recognise that it is paramount to engage with local communities, to create and shape relations into a level that goes beyond mere acceptance.” says Vitor Correia from the International Raw Materials Observatory and a Ciran project coordinator.

Mining has a bad image, Correia admits. But he says it is not fair: “It is true that the picture people have of mining has been shaped by past behaviours that were not good examples.” Correia says the media is to blame for spreading “bad news” about the sector. "However, these mainly come from less developed countries, thereby forgetting all the good examples that we have in Europe, where good practices in mining operation and aftercare prevailed for more than 30 years.”

Europe now wants to increase its domestic mining practices. In March, the European Commission presented its Critical Raw Materials Act, a legislation aimed at reducing EU dependency on third countries for commodities such as lithium, nickel and rare earth elements.

The Horizon funding reflects the growing interest in CRMs. Of the €667 million ringfenced for projects between 2014 and 2023, more than €300 million was allocated to projects starting in the past two and half years.

Entities in Germany, Spain, Finland, France and Norway have received the most money. Almost 90 per cent went to groups registered in the EU, including the UK in the case of Horizon 2020 money. In total, entities from 57 countries have received some form of Horizon funding.

Mining has a bad image, Correia admits. But he says it is not fair: “It is true that the picture people have of mining has been shaped by past behaviours that were not good examples.” Correia says the media is to blame for spreading “bad news” about the sector. "However, these mainly come from less developed countries, thereby forgetting all the good examples that we have in Europe, where good practices in mining operation and aftercare prevailed for more than 30 years.”

Europe now wants to increase its domestic mining practices. In March, the European Commission presented its Critical Raw Materials Act, a legislation aimed at reducing EU dependency on third countries for commodities such as lithium, nickel and rare earth elements.

The Horizon funding reflects the growing interest in CRMs. Of the €667 million ringfenced for projects between 2014 and 2023, more than €300 million was allocated to projects starting in the past two and half years.

Entities in Germany, Spain, Finland, France and Norway have received the most money. Almost 90 per cent went to groups registered in the EU, including the UK in the case of Horizon 2020 money. In total, entities from 57 countries have received some form of Horizon funding.

The mining lobby, taking advantage of the EU’s concern to increase European autonomy, is pushing for an increase in public funding. Its aim is to fund not only scientific research, as with Horizon, but also industrial developments and exploration projects.

The truth is that, beyond the Horizon schemes, there is already more public money - not for mining directly, but for the broader industry. Between 2017 and 2022, the European Investment Bank financed 26 projects with €3.6 billion, according data given to Investigate Europe by the EIB. Most went on battery developments.

National and regional budgets of member states are a source of public money for some mining companies. On 9 August, for example, the European Commission gave the green light to a €26.7 million subsidy granted by Spain to Cobre Las Cruces to modernise its refinery at the Seville mining complex. The Commission believes that this state aid will contribute to the objectives of the European Green Deal. This is despite the fact that Cobre Las Cruces is not always exactly a good example of "green" practices. Since the events that led to three of its executives being convicted for environmental crime, the Spanish government has twice sanctioned the firm for illegally retaining water in its mining operation.

Editors: Chris Matthews and Ingeborg Eliassen

Graphics: Marta Portocarrero

The truth is that, beyond the Horizon schemes, there is already more public money - not for mining directly, but for the broader industry. Between 2017 and 2022, the European Investment Bank financed 26 projects with €3.6 billion, according data given to Investigate Europe by the EIB. Most went on battery developments.

National and regional budgets of member states are a source of public money for some mining companies. On 9 August, for example, the European Commission gave the green light to a €26.7 million subsidy granted by Spain to Cobre Las Cruces to modernise its refinery at the Seville mining complex. The Commission believes that this state aid will contribute to the objectives of the European Green Deal. This is despite the fact that Cobre Las Cruces is not always exactly a good example of "green" practices. Since the events that led to three of its executives being convicted for environmental crime, the Spanish government has twice sanctioned the firm for illegally retaining water in its mining operation.

Editors: Chris Matthews and Ingeborg Eliassen

Graphics: Marta Portocarrero