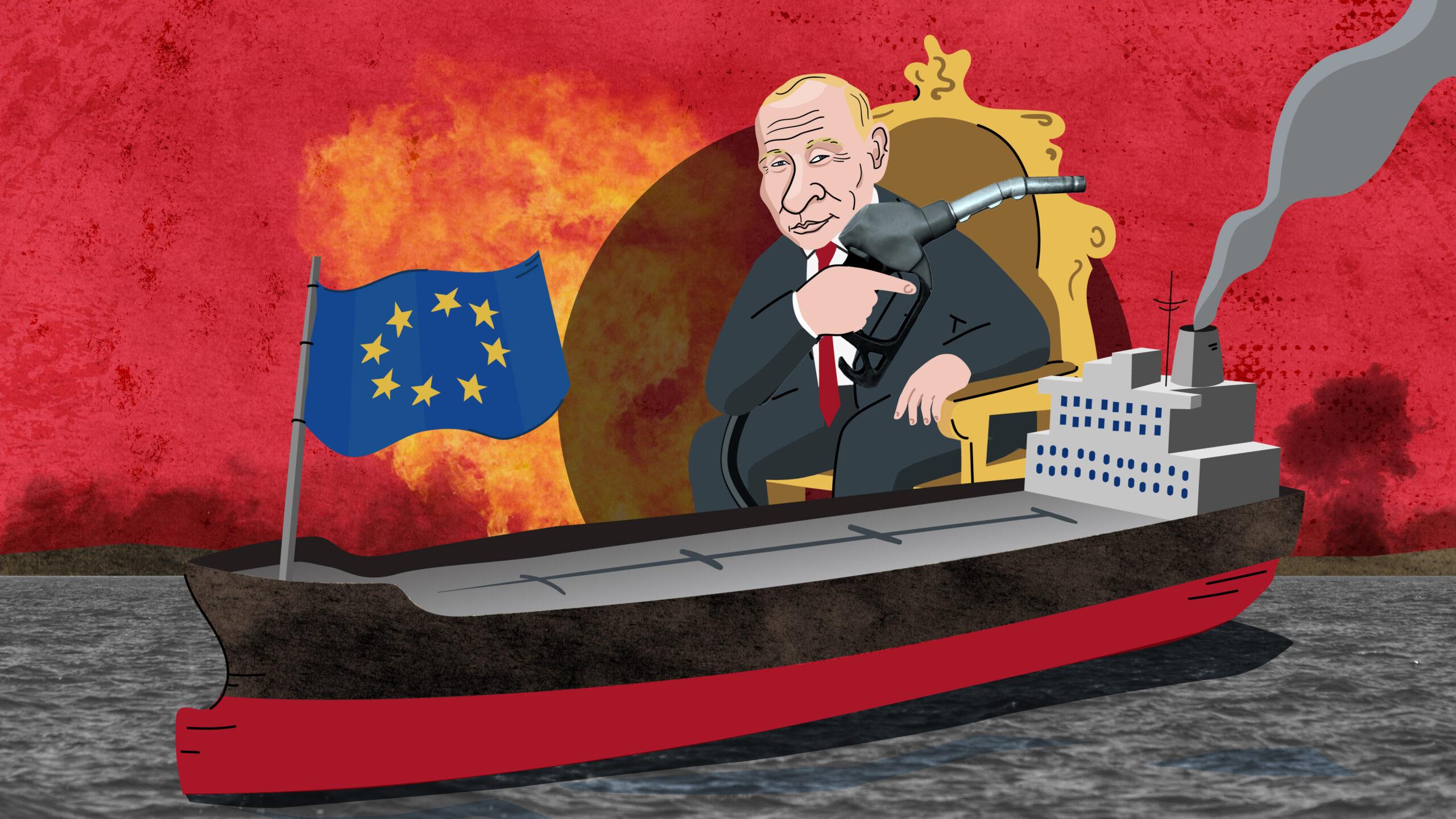

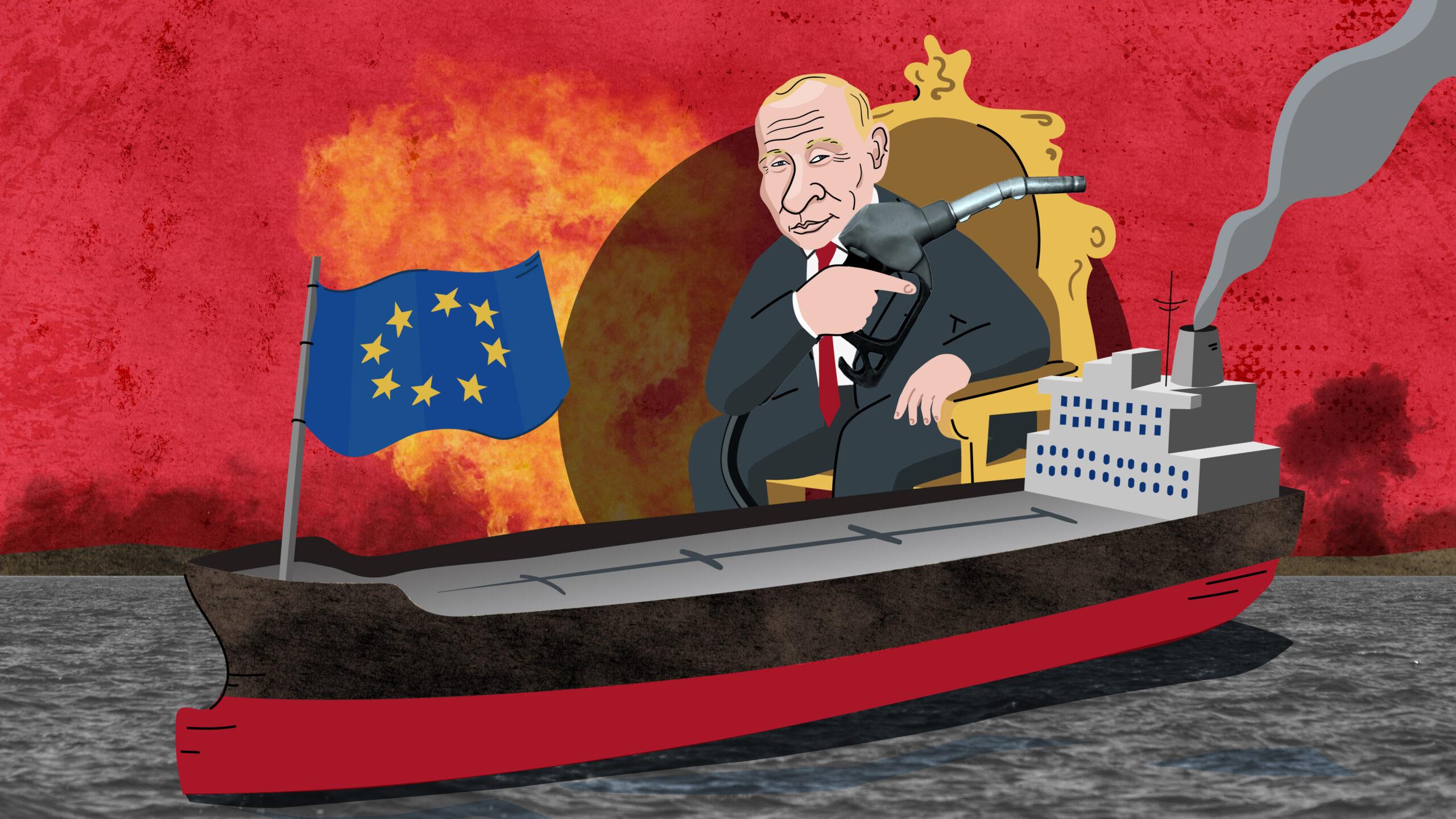

About Fuelling WarEurope is set to phase out its dependence on Russian oil, gas and coal. But as new sanctions are looming and import volumes sink, a vast network of European ships continues to transport billions of euros worth of fossil fuels and help fill the pockets of the Russian state.

Cross-border stories from a changing Europe, in your inbox.

Cross-border stories from a changing Europe, in your inbox.